Choosing the right credit card can seem overwhelming, especially when you want it to align with your commitment to sustainability. However, the growing demand for environmentally-friendly options has led to more banks offering cards from sustainable sources or ones that contribute positively to the environment.

A sustainable credit card doesn’t just benefit your wallet but also the planet, helping you align your financial habits with your values. Let’s explore how you can choose a credit card that fits your sustainable lifestyle, ensuring your choices reflect and support green initiatives.

Analyzing Green Certifications for Credit Cards

An essential aspect of choosing the right green financial product is understanding the meaning of certifications and labels that indicate eco-friendliness. Many financial products now highlight their commitment to green practices by showcasing certifications like carbon-offset programs or supporting renewable energy initiatives. Look for indicators like reduced plastic usage in card materials and partnerships with eco-friendly organizations.

These certifications not only assure you of the validity of their sustainable claims but also reinforce your decision to support businesses dedicated to environmental sustainability. In addition, it’s critical to consider the institutions’ investments when selecting your credit product.

Many banks invest your money into various enterprises, so it’s worth digging into whether your prospective card issuer supports sustainable enterprises or industries that counteract pollution and climate change. This transparency means that your everyday transactions indirectly contribute to green projects around the world, reinforcing your sustainable lifestyle through mindful financial choices.

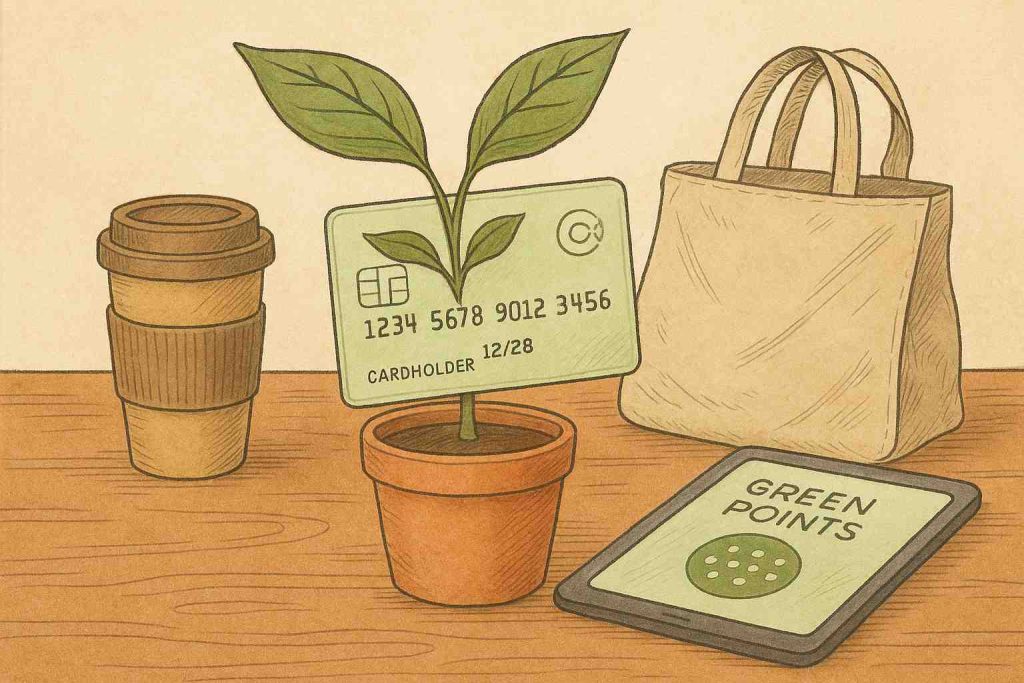

Exploring Rewards That Benefit the Environment

Some credit cards go beyond offering points for purchases, providing rewards that positively impact the planet. Look for financial products with reward programs that support eco-friendly projects or offer cashback incentives that can be donated to environmental charities. Some cards even offer the opportunity to accumulate points which can be exchanged for carbon offsets or credits.

By choosing a product with these benefits, you not only optimize your rewards but also contribute to a broader cause, making every transaction a step toward a greener world. Making such choices also encourages financial institutions to continue or even expand their environmentally-friendly offerings, as demand directly influences the market.

Investigating available rewards and talking with representatives about additional benefits tied to sustainability can guide your decision. As more people prioritize eco-conscious living, the availability of these options is likely to increase, giving you even more choices to align your financial behaviors with eco-friendly objectives.

Practical Tips for Choosing Your Sustainable Credit Card

Before making a decision, analyze your spending habits and financial goals. Understanding where you frequently spend your money and how you can accumulate rewards provides clarity on which card might benefit you. Additionally, check for product-specific perks like waived annual fees or introductory offers that support sustainable purchases, such as discounts at green retailers or products.

Each card varies in what it offers, so take the time to compare features and ensure your choice supports your lifestyle and the environment. Reach out to customer service for detailed clarification on partnerships and sustainable initiatives. Companies with a strong commitment to sustainability are usually transparent about their practices and happy to share their eco-friendly credentials.

Let Your Credit Choices Reflect the Future You Believe In

Incorporating sustainability into your financial decisions can significantly impact your contribution to a healthier planet. Selecting a credit product that aligns with your environmental ethics is one crucial step toward broader eco-conscious living.

As credit options featuring green initiatives and rewards continue to expand, they’re making it easier for consumers to align their financial habits with their values. By choosing wisely, you are helping drive the demand for more sustainable financial services. Let your wallet be a vehicle for positive change, every swipe bringing you closer to a sustainable future.