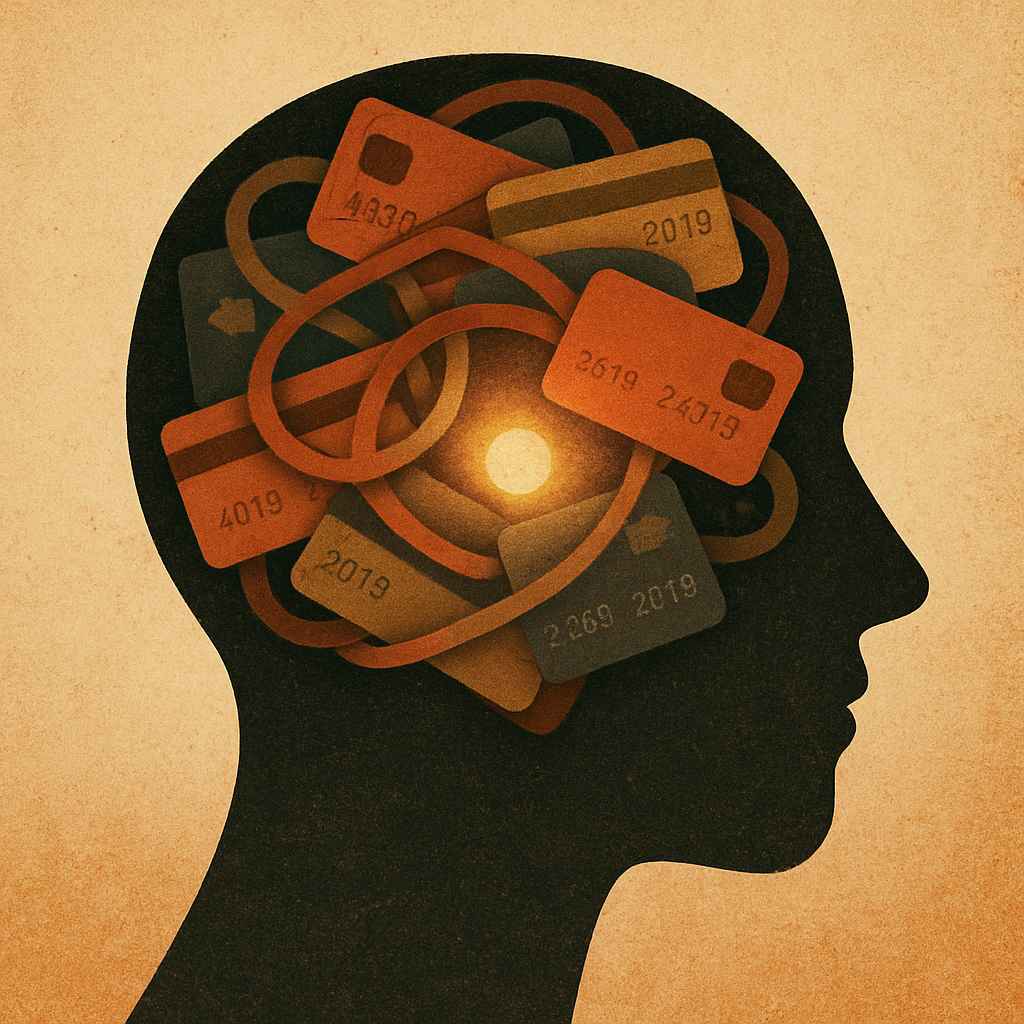

The digital marketplace continues to evolve, and as it does, the introduction of temporary virtual credit cards has garnered significant attention. Users in the U.S., in particular, are increasingly drawn to these innovations. While traditional credit methods remain a staple, virtual cards have emerged as a beacon of enhanced security.

In a world where cyber threats lurk, credit cards in their digital form offer an effective shield for consumers navigating the online shopping terrain. These temporary solutions are redefining financial transactions, making the online environment safer and more user-friendly.

Temporary digital solutions: a closer look at virtual credit cards

The adoption of temporary virtual cards is rising at an impressive rate. Unlike their physical counterparts, these digital cards are often generated on-demand, offering a unique number for a single transaction or short-term use. This limits the chance of fraud since the card details change frequently and cannot be reused by malicious actors.

One distinct advantage of using temporary digital cards is convenience. Many banks and financial institutions provide them through mobile apps or online platforms, allowing users to create virtual cards quickly. This hassle-free process ensures that shoppers are not only protected but also enjoy a smooth purchasing experience.

How do temporary virtual credit cards work?

Virtual credit cards function using the same principles as traditional cards, but with added flexibility. When a user initiates an online transaction, they’re issued a unique set of numbers linked to their main account but different from the actual card details. These numbers are typically valid for a short period or for one-time use, mitigating the threat of fraudulent activities.

This innovative approach is perfect for frequent online shoppers or those making purchases on unfamiliar websites. By using virtual numbers, consumers drastically reduce the likelihood of unauthorized transactions. Moreover, many services allow for easy management of spending limits and expiration dates, giving users better control over their finances while adapting to their specific shopping habits.

Embracing the future: the impact of digital card adoption

As digital credit card usage grows, we are witnessing a shift in consumer behavior. The assurance offered by these virtual solutions is prompting more individuals to explore online shopping avenues they might have previously hesitated to try. For retailers and financial institutions, this means an opportunity to build trust with customers and expand their market reach.

In conclusion, the rise of temporary virtual credit cards represents a significant advancement in ensuring online transaction security. As the U.S. continues to navigate the digital landscape, these innovations are setting new standards. Enhanced privacy, ease of use, and fraud prevention make them indispensable tools for today’s savvy shopper.

👉 Also read: Credit Cards With Benefits For Grocery Store Purchases: Which Ones Offer The Most Savings In The U.S. In 2025