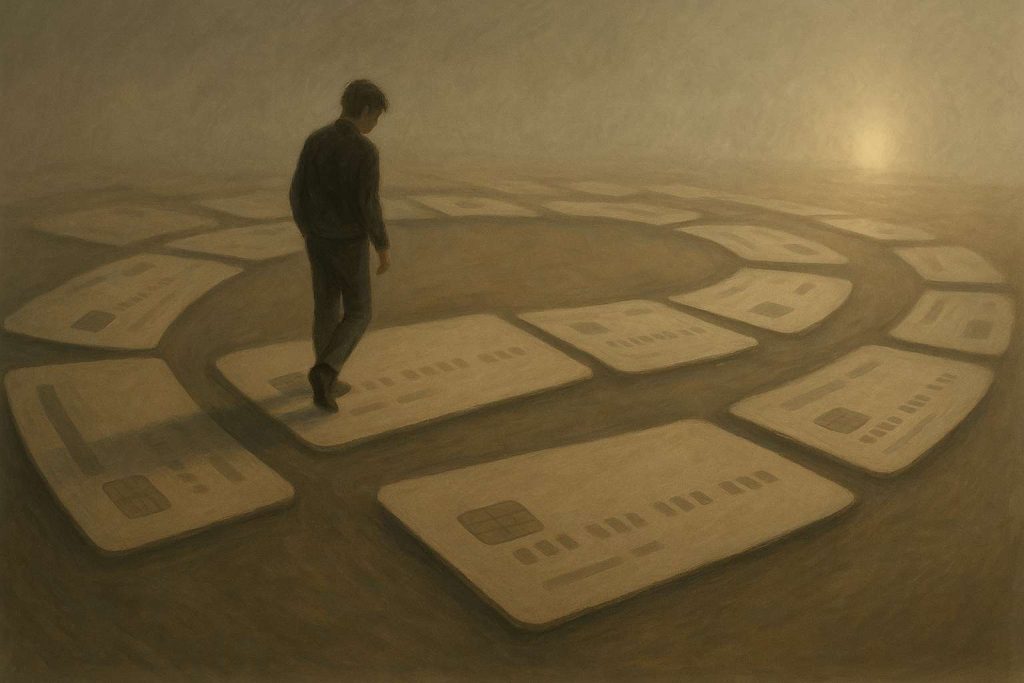

With the rise in credit card usage across the United States, many individuals find themselves trapped in a cycle of spending that can feel impossible to escape. The allure of instant gratification often overshadows the future financial burdens tied to credit card debt. Understanding the psychology behind why so many fall into this trap can help illuminate ways to break free and regain control over personal finances.

The credit card has evolved from a convenient financial tool to a facilitator of unsustainable spending habits for many Americans. It’s crucial to delve into the reasons behind this phenomenon to effectively address and overcome it, ensuring financial health and peace of mind.

The psychology of spending

At the heart of the credit card overuse problem is the psychology of spending. Consumers often experience a disconnect when using plastic instead of cash, leading to underestimating the actual money being spent. This “abstract money” phenomenon is a significant factor that drives people to use their cards more frequently and for larger purchases.

Aside from the abstract nature of digital transactions, the immediate gratification provided by credit purchases can create a dopamine rush, reinforcing a cycle of overspending. Understanding these psychological triggers is vital in developing strategies to counteract them and promote healthier spending behaviors.

The role of societal influence

Society also plays a critical role in credit card overuse. Social media platforms showcase extravagant lifestyles, influencing individuals to match these often unrealistic standards. The pressure to “keep up” with peers can lead to overspending on unnecessary items using credit. Additionally, cultural norms around consumerism fuel this behavior, perpetuating the idea that possessions equate to success and happiness.

The continuous exposure to advertisements and influencer marketing amplifies this desire for material goods, making it harder for individuals to resist the urge to swipe their cards. Recognizing and resisting societal pressures can be an essential step toward financial independence.

Breaking the cycle of overspending

Understanding the drivers behind excessive credit card use is only the first step. To truly break free from the cycle, practical strategies must be implemented. Building awareness around personal spending habits by examining monthly statements can provide insight into where cutbacks can occur. Creating and sticking to a budget is another crucial step in ensuring expenditures don’t exceed income.

Additionally, setting specific financial goals can serve as motivation to minimize unnecessary spending. By shifting focus onto saving for tangible aspirations such as travel or a future investment, individuals can recalibrate their spending behavior and improve their financial situation.

Practical tips to regain control

To practically manage credit card usage, start by limiting the number of cards in use. Focus on one or two that offer the most beneficial rewards for your lifestyle needs without incurring unnecessary costs. Pay off the balance in full each month to avoid interest charges, and consider setting alerts for purchase limits to prevent overspending.

Another useful tactic is freezing cards—both literally and figuratively—and using debit cards for everyday purchases. By relying on money you physically have, you’re less likely to fall into debt. These strategies, combined with consistent tracking of expenditures, can set the foundation for a controlled and mindful approach to using credit.

Credit habits that heal, not harm

Credit card overuse is a widespread issue, rooted deeply in human psychology and societal pressures. By understanding the underlying reasons for this behavior, it is possible to develop effective strategies to alter spending habits. Breaking free from a cycle of debt can enhance not only financial health but also overall well-being.

Ultimately, fostering healthy financial habits requires ongoing effort and self-awareness. By implementing practical solutions and remaining vigilant against consumer culture pressures, individuals can take definitive steps toward financial independence and security.